Table Of Content

Chase Bank may have a modern, trendy image, but it is one of the United States' oldest banks. Chase Bank is the consumer division of JP Morgan Chase, one of the largest banks in the United States. Even though its interest rates aren't particularly competitive compared to online banks and credit unions, loyal Chase customers who keep a large amount of money with the bank can earn slightly better rates.

While most central banks have had a difficult couple of decades, Chase is an exception. JP Morgan Chase was one of the big winners of the 2008 Wall Street meltdown, acquiring the majority of what was left of Washington Mutual.

American Express is best known for being a credit card company. However, the financial services firm also operates a banking subsidiary that provides high-yield savings and CD accounts and recently launched its first rewards checking account. The American Express High Yield Savings Account is a popular option for those looking to save money with a well-known financial institution.

As an online-only bank, Amex Bank cannot provide customers with in-person support at local branches. However, it offers phone support 24 hours a day, seven days a week.

Banking Options

Chase | American Express | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

When comparing American Express and Chase savings accounts, it is immediately apparent that American Express has far better rates, with an impressive 4.30% that makes it one of the best choices for a savings account.

Another advantage is that the American Express savings account is fee-free, while Chase charges $5 per month unless you can meet the requirements.

Additionally, while American Express and Chase have withdrawal limits, Amex allows nine compared to the 6 with Chase.

Chase | American Express | |

|---|---|---|

APY | 0.01% | 4.30% |

Fees | $5 per month

Can be waived if you carry $300 account balance at the start of the month, $25+ autosave or linking a Chase checking account

| $0 |

Minimum Deposit | $25 | $0 |

Checking Needed? | No | No |

Main Benefits |

|

|

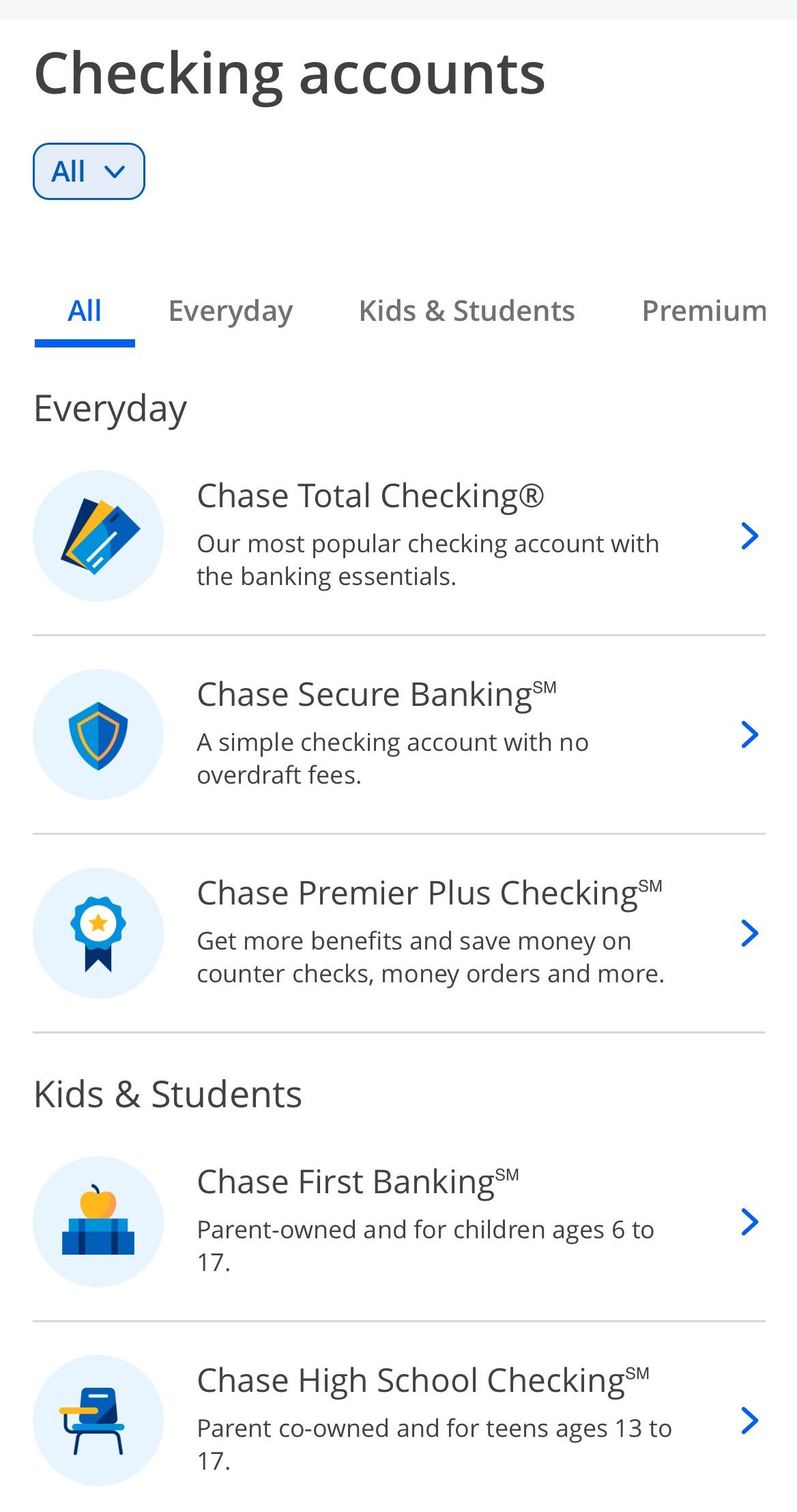

Checking Account

Chase is the most popular bank in the US, including various options for personal banking, many branches, and much more personal access than Amex.

Chase offers several options for checking accounts, such as the famous Total Checking, which is the most popular, Chase Premier Plus account, Chase College account for students, and even a premium account for Chase customers – Chase Private Client.

Amex offers higher APY on the cash you carry in your Amex checking account, there are no monthly fees, and you may use an app and debit card to manage your account. Unlike other online checking accounts, you can earn American Express rewards, which you can use for travel, gift cards, or experiences.

You’ll earn one point for every $2 you spend on eligible purchases made with your debit card. Eligible purchases are goods and services less any returns or other credits.

Chase | American Express | |

|---|---|---|

APY | None | 1.00% |

Fees | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| $0 |

Minimum Deposit | $0 | $0 |

Main Benefits |

|

|

CDs

As of April 2024, Amex CD rates are better than Chase, but Chase offers a variety of CD terms, unlike Amex.

Also, Amex doesn't have a minimum deposit.

American Express | Chase | |

|---|---|---|

Minimum Deposit | $0 | $1000 |

APY Range | Up to 4.75% | 3.00% – 4.75% |

APY 6 months | / | 3.00% |

APY 12 months | 4.00% | 2.00% |

APY 24 months | 4.00% | 2.50% |

APY 36 months | 3.00% | 2.50% |

No Penalty CD | / | / |

Credit Cards

American Express is well known as an established credit card provider, so it is no surprise that there is an impressive choice of card options. There is a choice of reward cards including the Platinum card that pays 5x membership reward points, but has an annual membership fee of $695.

If you want a lower annual membership fee, the Gold Card is $250 and offers 4x points or the Green Card has a $150 annual fee and offers 3x points. There are other reward card options offering varying reward levels including the Amex EveryDay, Amex EveryDay Preferred and Blue Card.

If you prefer cash back cards, American Express has decent options. Blue Cash EveryDay, Blue Cash Preferred and Cash Magnet offer as much as 6% cash back depending on the card. Additionally, there is no annual fee, apart from after the first year with the Blue Cash Preferred.

American Express also offers SkyMiles and Hotel Cards, but there is also a prepaid Serve card that can help you to build your credit with no credit check on application. Additionally, if you receive a direct deposit of $500+ in the statement period, the $6.95 monthly fee is waived.

Card | Rewards | Bonus | Annual Fee |

| Blue Cash Preferred® Card from American Express | 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $95 ($0 intro for the first year) |

|---|---|---|---|---|

| Blue Cash Everyday® Card from American Express | 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

| $200

$200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months

| $0 |

| The Amex EveryDay® Credit Card

| 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

| 10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

| $0 |

| American Express Cash Magnet® | 1.5%

unlimited 1.5 percent cash back on all purchases

| $150

$150 statement credit for spending $1,000 in the first 3 months of account opening

| $0 |

| Delta SkyMiles® Gold American Express Card | 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

| $150, $0 intro first year |

| American Express® Gold Card | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 60,000 points

60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership

| $250 |

| The Platinum Card® from American Express | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

| $695 |

| Hilton Honors American Express Card | 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 |

Chase credit card options are almost higher than any other credit card company. This includes 20+ Travel cards, 7 hotel cards and 7 business cards. Chase partners with United, Southwest, Avios, Hyatt, Amazon, Disney and even Starbucks, so you can tailor your card to your preferred brands to get the best rewards.

Most of the cards have no annual fee, but there are some notable exceptions, such as the Sapphire Preferred that offers an extensive rewards for its customers. Chase has some of the best rewards credit cards in the market.

Chase also has some innovative cards like the Slate Edge that allows you to lower your interest rate by up to 2% each year, with an automatic review to obtain a higher credit limit when you spend $500 in the first six months and pay on time. Chase even has a Freedom Student card that allows those in full time education to earn 1% cash back on all purchases with no annual fee.

Card | Rewards | Bonus | Annual Fee |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

| $200

| $0 |

| Chase Freedom Unlimited® | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $550 |

| Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| $95 ($0 first year) |

Personal Loans

Chase no longer provides unsecured personal loans, whereas American Express does. However, loans are only accessible to pre-approved Amex card members, so you won't be able to apply unless you already have an Amex account. American Express offers terms of 12, 24, and 36 months. The terms available to you will be determined by the size of your loan and your credit score.

Remember that shorter loan terms result in higher monthly payments and lower interest costs. Longer terms have lower payments but higher total costs. These loan terms are perfect for people who only need a personal loan for a short time.

The proceeds of an Amex loan, like most personal loans, can be used for almost anything, such as debt consolidation, wedding, or home improvement.

American Express | |

|---|---|

APR | 6.98% – 19.99% |

Loan Amount | $3,500 – $40,000 |

Terms | 12-36 months |

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Customer Service

American Express offers 24/7 customer support online or on the phone, so if you have a query or need help, you can easily access the customer service team. You can easily access the customer service team if you have a query or need help

Chase’s customer service system is quite comprehensive. In addition to an in-depth help website page, there are customer service lines, Twitter and Facebook support 7 am to 11 pm ET Monday to Friday, and 10 am to 7 pm ET on the weekends, or you can schedule a meeting with an agent in your local branch. Chase even has a dedicated line for military personnel and veterans, whether here or overseas.

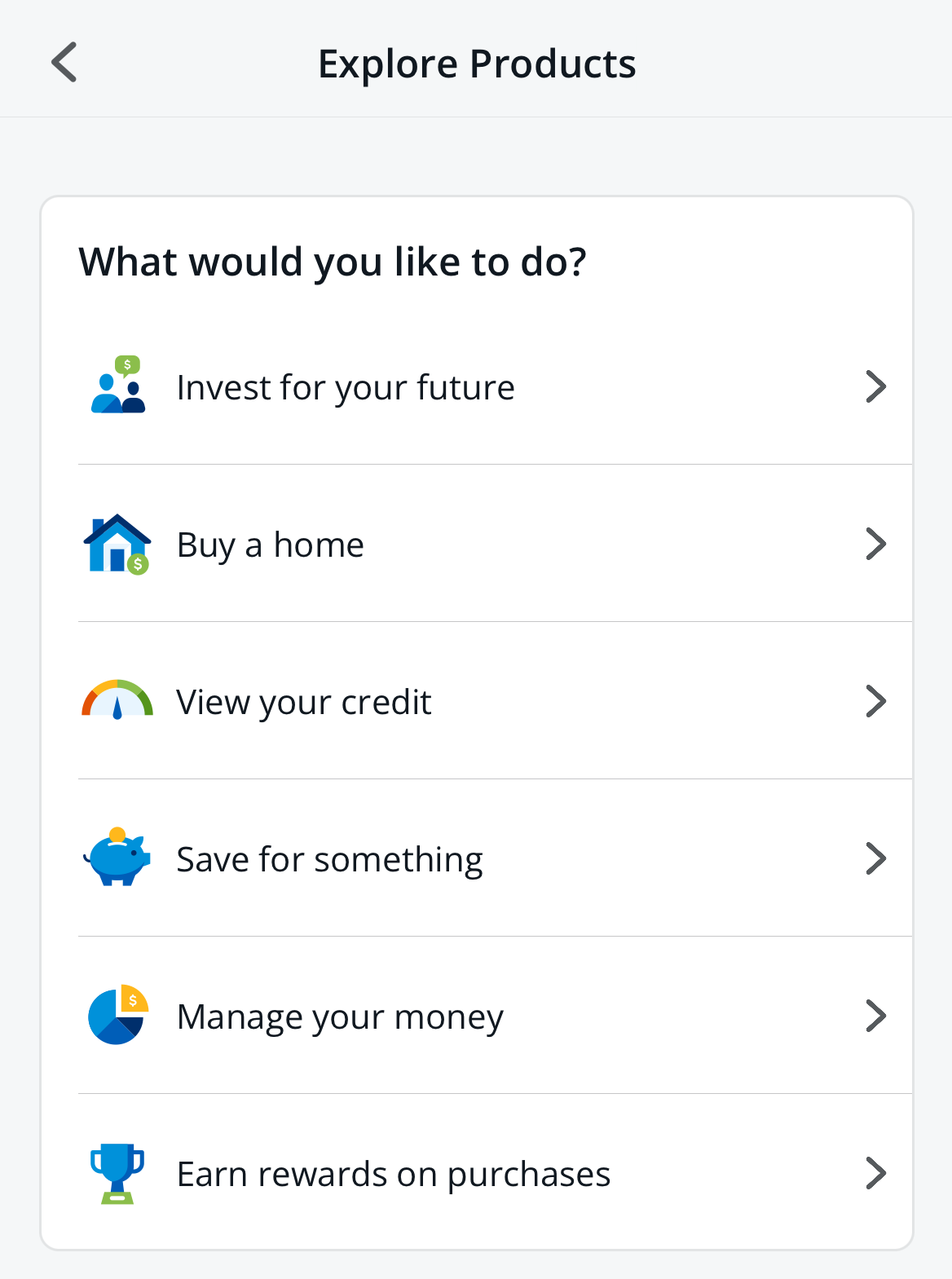

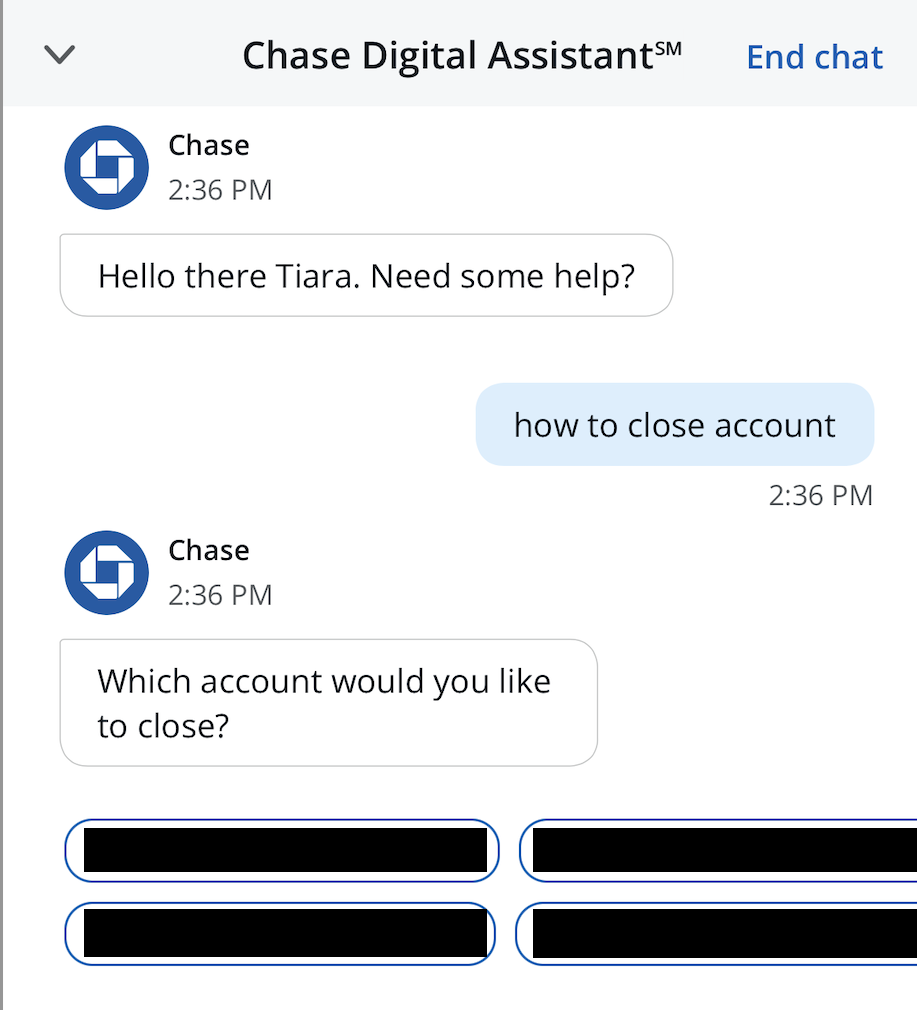

Online/Digital Experience

Both American Express and Chase have an app for iOS and Android devices. The American Express app has a rating of 4.9/5 and 4.5/5 respectively on the Apple Store and Google Play. Chase’s app has similar ratings with 4.8/5 on the Apple Store and 4.4 out of 5 on Google Play.

Both sites have a clean design and are easy to use that offer a great user experience. You can fully explore and compare the products and access how-to videos and other support materials.

Which Bank is The Winner?

Both American Express and Chase are large reputable financial institutions, so to summarize which bank is better, we’ll need to recap the positives and potential negatives.

Chase has some innovative features, but American Express offers far better rates on savings. Chase offers promotions and bonuses for new customers, personal service and sophisticated loan products such as government mortgage.

However, Amex checking account has no fees, no minimum deposits and higher APY on your cash. While it's an online only bank, if you can skip the personal service – it may be a better option.

Both banks offer a vast choice of credit card options, so it really comes down to what rewards and what brands you prefer to decide which bank offers the best choice for you.

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 4.30% | 0.01%

| Up to 5.02%

|

Checking Fee

The monthly fee on checking account

| $0 | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Compare Banking |

Mobile App Rating | 4.8/5 on iOS 4.3/5 on Android | 4.8/5 on iOS 4.7/5 on Android | Various Banks

|

Learn More

| Learn More

| Compare

|

FAQs

What promotion does Chase offer?

Chase offers checking account bonuses as well as sign-up bonuses on many credit cards. As of April 2024 , the Chase Total Checking offers $300 bonus for new customers.

What promotion does American Express offer?

American express promotions are mainly relevant for new credit card customers, but from time to time you can find welcome bonuses on other banking products.

Can you have more than one American Express credit card at the same time?

Because having multiple American Express cards multiplies the benefits of each card, the company must limit the number of cards that each individual can own.

A single account holder can currently apply for up to four American Express credit cards. Of course, depending on your credit score and credit history, your individual eligibility may vary.

Is American Express National Bank in general a good bank?

American Express has been in business since 1850 and is a household name in the credit card industry. As a national bank, this online-only platform has some outstanding features.

With no minimum deposit requirements or monthly fees, you can earn competitive rates on your savings. So, unless you're looking specifically for a checking account, American Express National Bank is a good option.

What is the primary disadvantage of American Express National Bank?

American Express National Bank has a limited product offering, with only savings and certificate of deposit accounts available. There are also no physical locations to visit, so all transactions must be completed online.

Is Chase Bank a good place to do your online banking?

Chase Bank is a full-service bank that dates back to 1799. While it has nearly 4,900 branches, it also provides excellent online banking services. With its online banking platform and popular app, the company has a strong digital presence.

The app is available for both Android and iOS devices and allows you to manage all of your Chase accounts at any time. Transfers, mobile check depositing, bill paying, account alerts, card lock, and automated savings are all included.

What is the main disadvantage of Chase Bank?

The main drawback is the low interest rate you'll get in most of Chase products. Compared to other high yield savings account and even compared to the national average – the rates are low.

Compare Chase Versus Alternative Banks

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know:

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Compare American Express Bank

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. They do not, however, provide as many products as Discover Bank does.

Read Full Comparison: Discover vs American Express: Which Bank Account Is Better?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

While CIT Bank lacks a credit card option, it does have a decent eChecking account, mortgages, and home loans. However, American Express has personal loans and an impressive choice of credit card options.

CIT Bank vs American Express: Which Bank Account Is Better For You?

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

U.S. Bank is one of the largest brick-and-mortar banks in the US, while Amex Bank is among the best online banks. Let's compare them: U.S. Bank vs. American Express Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare? American Express Bank vs. TD Bank

American Express and HSBC focus on serving wealthier customers by providing services and features beyond the standard. How do they compare? American Express Bank vs. HSBC Bank (USA)

Amex comes out on top with a solid checking option (which Barclays doesn't have), an excellent savings account, and great credit cards.

Barclays Bank vs. American Express Bank: Which Bank Account Is Better?

American Express is our winner with a decent checking account, an impressive savings account, and a great selection of credit cards.

Synchrony Bank vs. American Express Bank: Which Bank Account Is Better?

Banking Reviews

Alliant Credit Union Review

How We Compared Chase Bank and American Express: Methodology

In our comprehensive banking comparison, The Smart Investor team thoroughly assessed American Express and Chase Bank across five main categories:

- Checking Accounts (30%): We scrutinized essential features like direct deposit, debit card availability, monthly maintenance fees, ATM and branch access, check deposit, bill pay options, and account alerts. Additionally, we considered any special checking account options and promotions offered to customers.

- Savings Accounts including CDs (20%): Our evaluation focused on critical factors such as APY (Annual Percentage Yield), minimum deposit requirements, Terms and Flexibility of accounts, and the assurance of FDIC insurance. We also examined special savings options, variety of CDs, automatic renewal options, and early withdrawal penalties.

- Credit Cards (15%): We analyzed the rewards program, annual fees, intro bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards, ensuring a comprehensive comparison of available features.

- Lending Options (15%): We assessed the variety of lending options available, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, providing consumers with insights into the bank's lending capabilities.

- Customer Experience And Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, customer support accessibility, online reviews, JD Power research, Trustpilot ratings, and the overall Financial Stability of each bank, ensuring a holistic view of customer experience and reputation.