Table Of Content

Bank of America provides banking services and free ATMs almost everywhere in the United States. Their savings rates and account fees are comparable to those of other banks. Bank of American is a nationwide network that provides all-in-one banking services such as deposits, loans, and credit cards. There are also higher daily limits on their ATM and debit purchases, which is a great incentive to improve your financial situation.

Banking with this company has some drawbacks. Savings account interest rates are lower than average, and there are fewer premium checking account options. These are important banking considerations to keep in mind when determining your short and long-term financial goals. Another disadvantage of banking with Bank of America is that their fees are higher than those of their competitors.

Aspiration presented their company in a very different way than their bank competitors. They are technically an SEC-registered financial broker-dealer that has partnered with a bank to provide banking products and services.

One feature that distinguishes them from their competitors is that they allow their customers to choose how much they want to pay for their services. The customer can set the fee that they believe is fair or appropriate for the level of service they receive. This means that customers can pay nothing if they believe the bank is deserving of it. The customer has the option to change the fee at any time. Furthermore, 10% of the fees collected from customers are donated to charity. In addition, Aspiration is a green company.

Banking Options

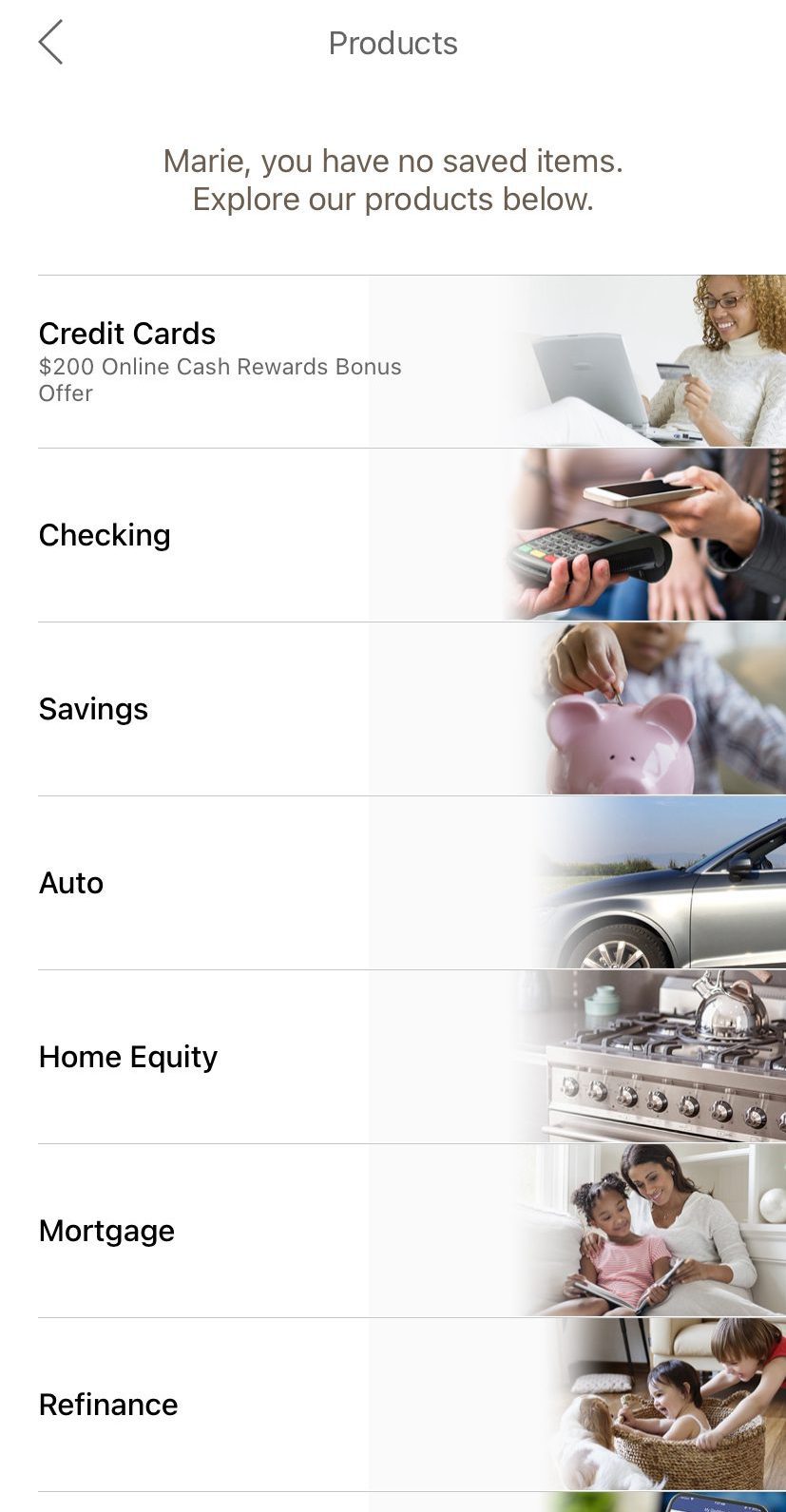

Bank of America has a comprehensive banking product line. In addition to its multiple credit card options, there are checking and savings accounts. You can also access auto loans, home loans, and investment options.

This makes the transition from a conventional bank a lot smoother, as you will find many of the products you expect.

Aspiration has a minimal product line. There are two Spend and Save options, which allow you to upgrade to a $7.99 monthly payment to earn higher rates on your balance and more cash back for sustainable purchases.

This in combination with the one credit card option can take care of your basic banking needs, but if you are looking for more banking products, it may be better to look to Bank of America.

Aspiration Bank | Bank of America | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

Aspiration’s Spend & Save account is a hybrid account, combining savings and checking, but for this comparison, we’ll look at the pure savings features. In this regard, Aspiration offers far better rates compared to Bank of America. Even Preferred Rewards members can only receive 0.04%, while Aspiration offers 3% for up to $10,000.

However, you won’t earn any interest on any amount above the 10k. Additionally, the Pay What’s Fair approach to maintenance fees means that you don’t need to worry about fee waivers, as you would with Bank of America.

Aspiration Bank | Bank of America | |

|---|---|---|

APY | Up to 3.00% | 0.01% – 0.04% |

Fees | $0 | $8 per month

Can be waived by maintaining a balance of $500+, becoming a Preferred Rewards member or linking to your B of A Advantage Banking account. Fees are also waived for enrolled students aged under 24

|

Minimum Deposit | $10 | $100 |

Checking Needed? | No | No |

Main Benefits |

|

|

Checking Account

Again, Aspiration has the edge with regards to checking account features. While Bank of America has a minimum account opening deposit of $100, Aspiration requires just $10. Additionally, you can earn 3% on your balance, while Bank of America does not pay interest on checking account balances.

However, Bank of America does have the advantage of being an established, large bank. So, there is a larger support system and features that you may only get with a large bank, such as setting your own overdraft terms.

Aspiration Bank | Bank of America | |

|---|---|---|

APY | 1.00% – 3.00% | 0.01% – 0.02% |

Fees | $0 | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

|

Minimum Deposit | $0 | $25 – $100 |

Main Benefits |

|

|

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

CDs

There is no comparison here, as Aspiration does not currently offer CDs. So, if you are looking for CD products, then Bank of America would be the better option.

Bank of America | |

|---|---|

Minimum Deposit | $1,000 |

APY Range | 0.05% – 5.00% |

Credit Cards

Bank of America is well known for its credit cards and has a massive choice of options. This includes a Customized Rewards card where you can select cash back tiers to suit your preferences and an Unlimited Rewards card with 1.5% cash back on all your purchases regardless of the spending category. Bank of America also has a Travel Rewards card offering miles, cash rewards card with 1-3% cash back and BankAmericard with a 0% introductory rate for the first 18 months.

Bank of America also has a similar variety of cards for students, including BankAmericard, Travel Rewards, Unlimited Cash Rewards and Customized Rewards options. There are also Secured Cards that allow those with less than ideal credit to earn rewards.

Bank of America also has a wide selection of partnership cards, teaming up with Susan G Komen, Amtrak, AllWays, Alaska Airlines and Free Spirit, so you can earn rewards by spending with your preferred brands.

Card | Rewards | Bonus | Annual Fee |

| Bank of America® Customized Cash Rewards credit card

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 |

|---|---|---|---|---|

| Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 |

| BankAmericard® credit card | N/A |

N/A

N/A

| $0 |

| Bank of America® Premium Rewards® credit card | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases

|

60,000 points

60,000 online bonus points for spending $4,000 on new purchases in the first 90 days of opening their card account. | $95 |

| Bank of America Unlimited Cash Rewards credit card | 1.5%

unlimited 1.5% cash back on all purchases

|

$200

$200 online cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $95 |

| Bank of America® Premium Rewards® Elite | 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| $550 |

On the other hand, Aspiration has just one credit card option; the Aspiration Zero. This card has been designed to help you towards being carbon neutral. The rewards are configured to encourage greener habits. You’ll receive 0.5% rewards on qualifying purchases when you start to use your card.

Aspiration will also plant up to two trees for every purchase. After planting 60 trees and therefore reaching carbon neutral status for the month, your rewards for the applicable period are doubled to 1%. You can use the Aspiration app to monitor your carbon footprint purchases and your reward potential. However, the card does carry a $60 annual fee.

Top Offers From Our Partners

Customer Service

As a larger bank, Bank of America does have a large customer service department. You can access live support 8 am to 9 pm ET Monday to Friday, at weekends 8 am to 8 pm on Saturday and 8 am to 5 pm on Sunday. You can also speak to the customer service team via the Bank of America social media channels or on the website.

Aspiration has a toll free number that is open 6 am to 6 pm PT Monday to Friday and 8 am to 4 pm PT on weekends. Aspiration does have social media channels, but it does not promote using them to contact the support team.

Online/Digital Experience

Both Bank of America and Aspiration have an app to help you to manage your accounts on the go. Bank of America’s app is rated 4.8/5 on the Apple Store and 4.6/5 on Google Play, while the Aspiration app is rated 4.7/5 on the Apple Store and 4.1 out of 5 on Google Play.

The bank’s websites are both easy to use, but Bank of America’s site does have more learning resources. Aspiration does have a “learn” section with details of sustainable investments, retirement planning and bankingץ

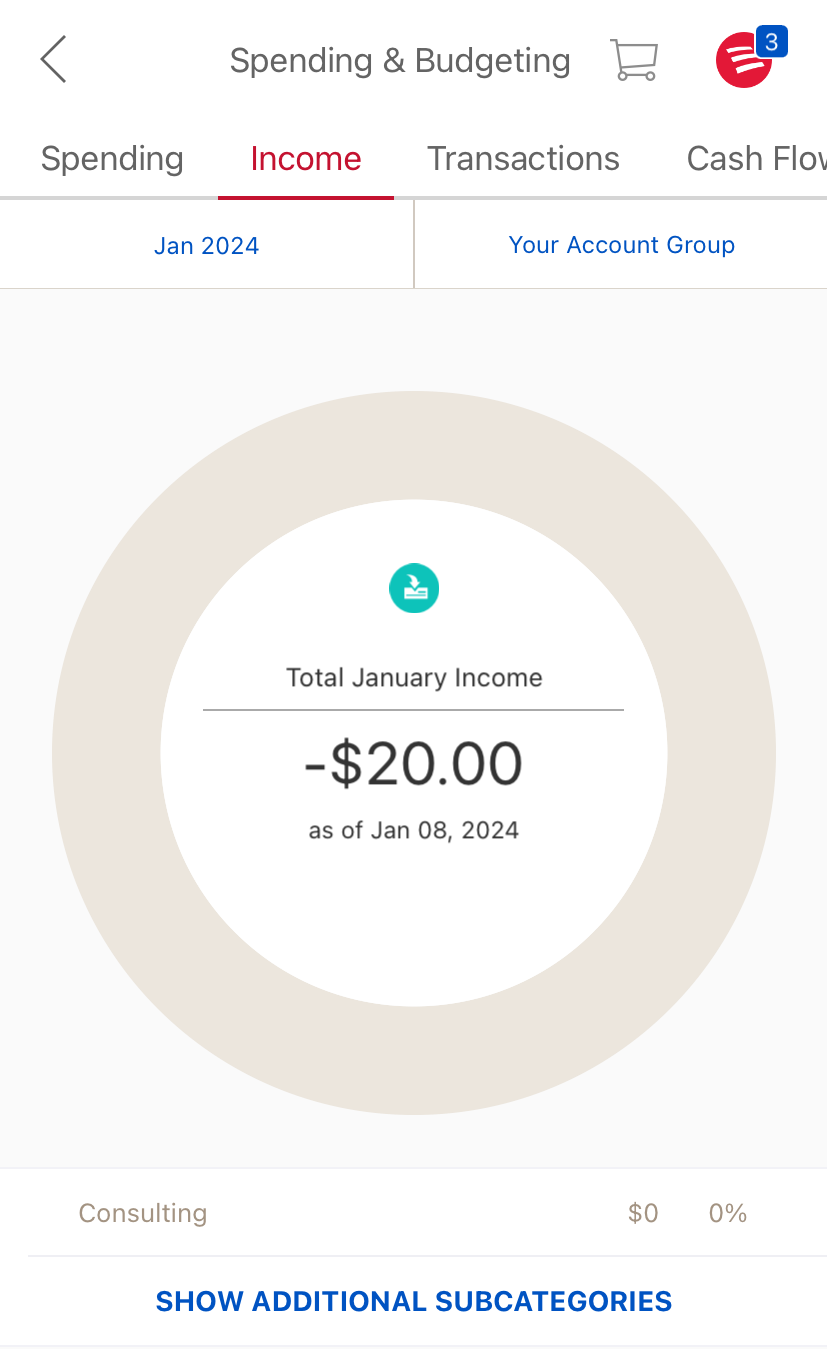

On the other hand, Bank of America has a comprehensive help section that allows you to explore all aspects of the bank’s products and finance in general, with Erica a virtual assistant to provide further help and guidance. Bank of America's budgeting tools offer a comprehensive overview of income and expenditures:

Aspiration’s entire site is designed around having a greener impact, so if this is not particularly of interest to you, you may find the site lacking details.

For example, while the product pages detail how your spending habits can work towards being carbon neutral, it is difficult to find details about the credit card rates and other terms. Bank of America’s site is far more clear cut.

You can simply select the products you’re interested in and even compare different products, if you’re unsure which one is right for you.

Which Bank is The Winner?

To sum up, we’ll need to look at which bank is better, depending on what you’re looking for.

If you’re interested in keeping all or most of your financial products with one bank, you’re likely to appreciate the sheer volume of Bank of America products. You can choose from different credit card options and find the right product for you. You can also manage your checking account, savings account, loans and mortgages all under one roof.

However, if you are happy with limited products that are more ethically designed, then the Aspiration ethos will appeal to you. While there is not a vast choice of product options, with one hybrid savings checking account, one credit card and limited investment options, you can’t really tailor the products to suit your requirements. But, you will get rewards for greener activities.

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 0.01% – 0.04% | Up to 3.00%

| Up to 5.02%

|

Checking Fee

The monthly fee on checking account

| $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| $0 | Compare Banking |

Mobile App Rating | 4.8/5 on iOS 4.6/5 on Android | 4.7/5 on iOS 4.1/5 on Android | Various Banks

|

Open Account

on Bank of America website | Open Account

on Aspiration website | Compare

on our website |

FAQs

Can I get a bonus or promotions on Bank of America?

Yes, Bank of America checking promotion is usually relevant for both new business and personal customers. For example, the Advantage Banking Account offers new accounts a $200 bonus as of April 2024.

Does Aspiration offer a promotion?

While there are limitations on the amount you should spend on Aspiration debit card, Aspiration usually offers a bonus for new accounts.

Aspiration let you decide what will be your fees. How does it work?

The customer can set the fee that they believe is fair or appropriate for the level of service they receive. This means that customers can pay nothing if they believe the bank is deserving of it. The customer has the option to change the fee at any time. Furthermore, 10% of the fees collected from customers are donated to charity.

It's a trust-based arrangement for the bank. They will make every effort to provide the best products and services to the public, and the customers will determine how much to pay. Customers will be charged at cost for additional services such as wire transfers.

Aspiration let you decide what will be your fees. How does it work?

The customer can set the fee that they believe is fair or appropriate for the level of service they receive. This means that customers can pay nothing if they believe the bank is deserving of it. The customer has the option to change the fee at any time. Furthermore, 10% of the fees collected from customers are donated to charity.

It's a trust-based arrangement for the bank. They will make every effort to provide the best products and services to the public, and the customers will determine how much to pay. Customers will be charged at cost for additional services such as wire transfers.

What is Aspiration Impact Measurement ?

The Aspiration Impact Measurement feature is a new addition to the Aspiration Spend account. It displays your own Sustainability Score – the impact you have on People and the Planet based on where you shop and spend your money every day. It also displays businesses that, based on their criteria, are doing good for the people of the world.

Aspiration integrated AIM People and Planet scores directly into your Aspiration app, allowing customers to easily see the scores of the places where they spend money.

Simply present your Aspiration debit card at AIM-rated businesses to view their People and Planet scores, as well as the scores of similar businesses.

What is the reputation of Bank of America?

- A+ on BBB – BBB assigns ratings ranging from A+ (highest) to F (lowest) (lowest). BB ratings are based on information in BBB files about factors such as the business's complaint history with the BBB, the type of business, the length of time in business, transparent business practices, and more.

- 4.7/5 based on BBB customer reviews (+180 reviews) – BBB customer reviews allow customers to leave positive, negative, or neutral feedback about their marketplace experiences.

- 4.7/5 on Trustpilot (+180 reviews) – TrustScore is an overall measure of reviewer satisfaction that ranges from 1 to 5.

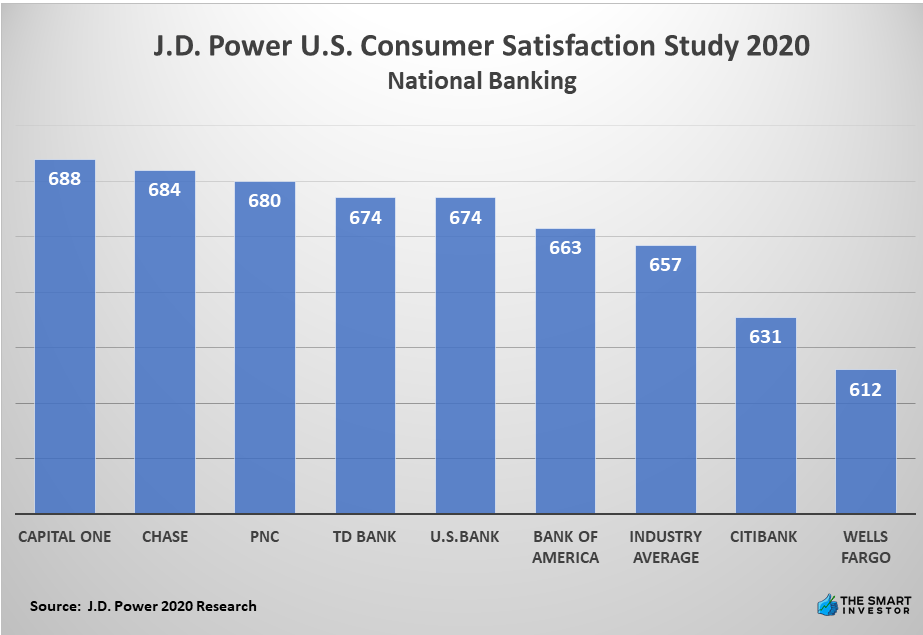

- Bank of America received 663 points in J.D. Power's 2020 national banking satisfaction study, which is slightly higher than the national average of 657 points.

What are the drawbacks of Bank of America checking account?

One disadvantage of the checking account system is that the interest rates are relatively low in comparison to other banking institutions. Furthermore, the requirements for waiving monthly fees are more stringent than usual.

There is also a $2.50 fee if you use a non-Bank of America ATM, which raises the fees if you are traveling or in a financial emergency.

Aspiration vs Bank Of America: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Bank of America and Aspiration in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare BofA With Alternative Banks

Since its inception as a credit card provider, Discover has come a long way.Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Bank of America offers a far more comprehensive range of banking services. There are numerous credit card options, as well as various savings and checking accounts.

Bank of America also provides mortgages, auto loans, and investments. This makes switching from a traditional bank much easier because you won't have to compromise on your banking products.

Read Full Comparison: Discover vs Bank of America: Compare Bank

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Bank of America has an impressive line of banking products, as one would expect from a large banking institution. Aside from various checking and savings accounts, there are auto loans, home loans, a variety of credit cards, and investment options. This makes switching from your current bank easier because you'll find many familiar products.

Chase also has a good selection of banking products. There are checking and savings accounts, auto loans, home loans, and home equity options, as well as a fantastic selection of credit cards.

Read Full Comparison: Bank of America vs Chase: Where to Save Your Money?

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Spend and Save is a SoFi savings and checking account hybrid. For the purposes of this comparison, we'll look at the savings features, of which there are a few. The most visible are the savings vaults. These enable you to set up separate funds to work toward different savings goals without the need for multiple accounts. This helps you organize your money, and you can even designate a vault for your round-up funds.

Bank of America offers a more traditional savings account, but it pays far less interest, ranging from 0.01 percent to 0.04 percent depending on your Preferred Rewards status, compared to SoFi's 0.25 percent. In addition, there is a $8 monthly maintenance fee that can be waived by keeping a balance of $500 or more in the account or linking your checking account. By linking your accounts, you can avoid going overdrawn with Balance Connect.

Read Full Comparison: SoFi Money vs Bank of America: Which Is Better For Your Needs?

Both banks have a decent selection of banking products, but there are some gaps in each line up. If you’re looking for the best returns, Capital One does have the edge in terms of CD and savings rates.

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Truist Bank vs. Bank Of America: Which Bank Account Is Better?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: TD Bank vs. Bank Of America

BMO is the winner when it comes to savings products, while Bank Of America offers many more credit card options. Here's our winner: Bank of America vs. BMO Bank

There is no clear-cut winner, but we prefer Bank Of America. But, there are cases when Citizens is best. Here's our comparison: Bank of America vs. Citizens Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why.

Bank of America vs. Fifth Third Bank: Which Bank Account Is Better?

We'll explore Bank of America and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Bank of America vs. M&T Bank

We believe Bank Of America is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Bank of America vs. KeyBank

While Regions Bank offers better checking accounts, Bank of America wins in credit cards and CDs. Here's our side by side comparison: Regions Bank vs. Bank of America

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?

Banking Reviews

Alliant Credit Union Review