Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Build Your Credit

- No Annual / Foreign / Balance Transfer Fee

- No Rewards

- No Perks

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Build Your Credit

- No Annual / Foreign / Balance Transfer Fee

CONS

- No Rewards

- No Perks

APR

30.74% (Variable)

Annual Fee

$0

Balance Transfer Fee

N/A

Credit Requirements

Fair - Good

- Our Verdict

- Pros & Cons

The Capital One Platinum Credit Card is an ideal option for those with average credit who need to take some time to build credit before they can qualify for a better rewards credit card. This credit card is designed for people with average credit, and it can help you get a good credit score without put down a deposit.

When using this credit card, you may qualify for a higher credit limit within 6 months of on-time payments and there is no annual fee. However, you won’t be able to participate in any rewards program and get the usual benefits as well any sign-up bonus.

If you are looking for a low cost credit card with no deposit, Capital One Platinum Credit Card is a good pick.

- Build Your Credit / Higher Credit Limit

- No Annual Fee

- No Foreign Transaction Fee

- Capital One's preapproval tool

- No Rewards

- No Sign Up Bonus

In This Review

Benefits

Let’s take a look at the benefits of the Capital One Platinum card and see if it’s the right one for your wallet or not.

- Build Your Credit / Higher Credit Limit

If you don’t have great credit and can’t qualify for a large credit line with most cards, then this one could be beneficial to you. You can use the Platinum card to build credit over time and you can get a credit limit raise after you make on-time payments for the first 5 months.

It’s a great perk considering most credit cards have low credit limits when you have a low or average credit score. Over time your credit line increases which reduce your credit utilization rate helping boost your score.

- No Annual Fee

Most credit cards have annual fees and they can be high fees running $95 to $295. A benefit you’ll enjoy with the Capital One Platinum card is not having to pay any annual fees.

This allows you to use the card as long as you need to until your credit improves and then switch to another card without worrying about an annual fee for keeping the Platinum card.

- No Foreign Transaction Fee

This card includes $0 foreign transaction fee, which can be great if you're spending some time abroad. Also, you get fraud liability, emergency card replacement, security alerts and some more cool travel perks.

- Capital One's preapproval tool

Capital One's preapproval tool give you the option to check your eligibility for the Platinum card. The preapproval tool is a soft inquiry and will not affect your credit score, which is beneficial for those who are already concerned about their credit scores.

Drawbacks

Let’s take a look at the drawbacks of the Platinum credit card and see if it’s the right one for your wallet or not.

- No Rewards

A major drawback of this credit card is that is has no rewards program where you earn cash back on purchases and no sign-up bonuses.

Considering the average credit card offers 1-2% cash back rates, if you spend $20,000 annually for example, that would be about $200 to $400 in cash back rewards.

This is what you’d be missing out on by choosing the no rewards Platinum card.

- No Sign Up Bonus

Unlike many other cards in the industry, the card doesn't offer any sign up bonus as well as other common credit card perks.

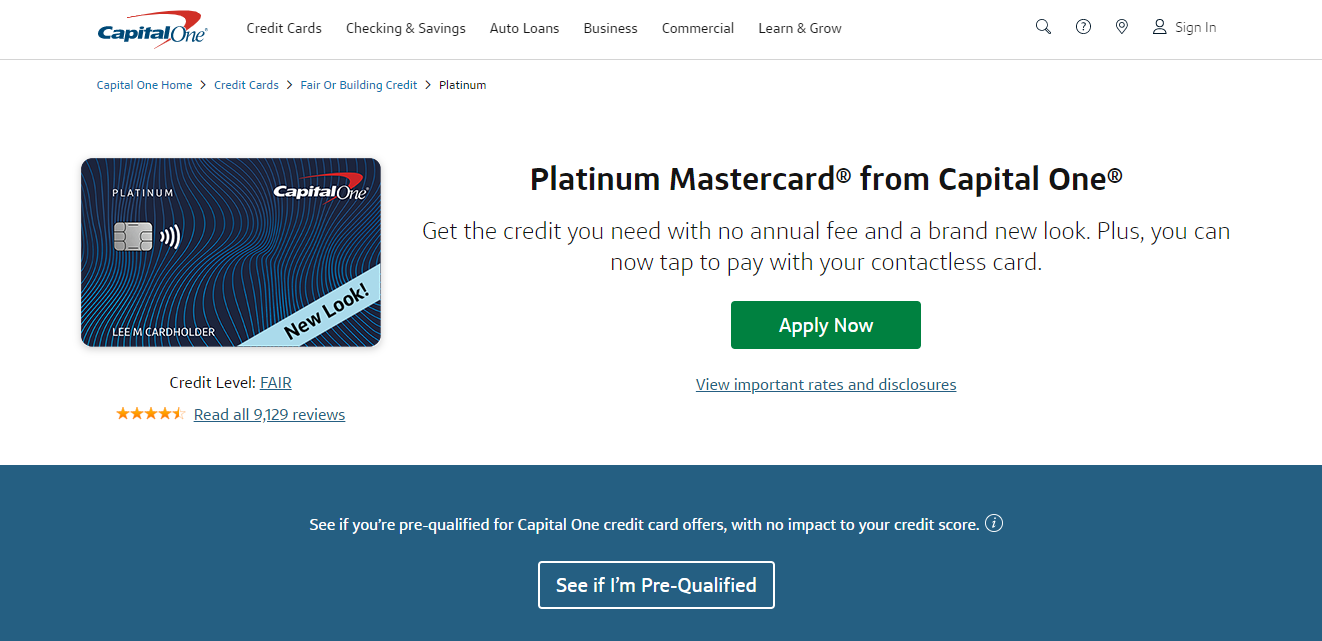

How To Apply For Capital One Platinum Credit Card?

- 1.

Visit the Capital One Platinum home page, and click on “Apply now”.

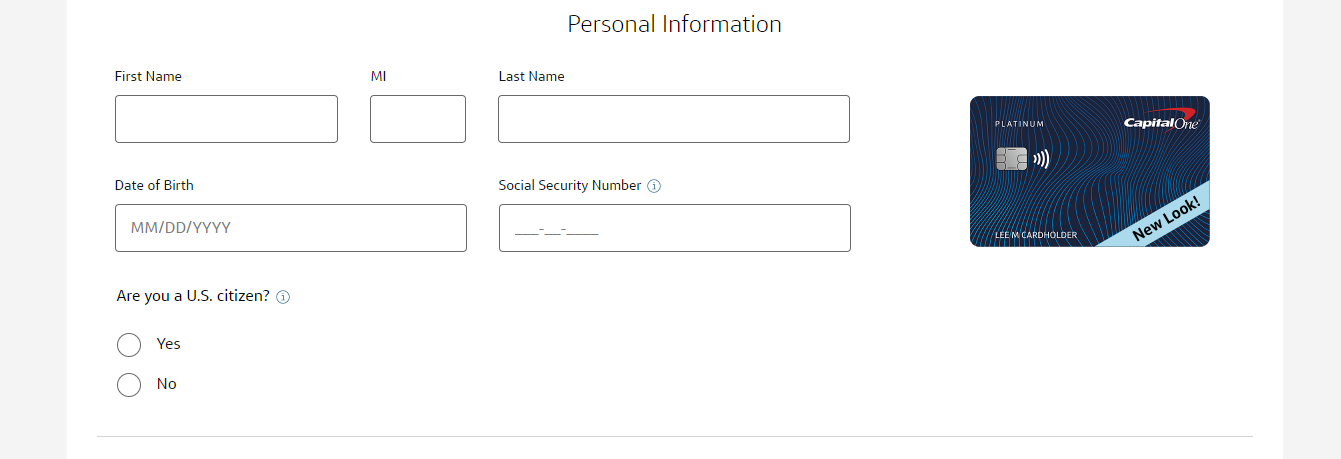

- 2.

The next page comes up where you can fill in your “Personal Information” like your names, date of birth etc.

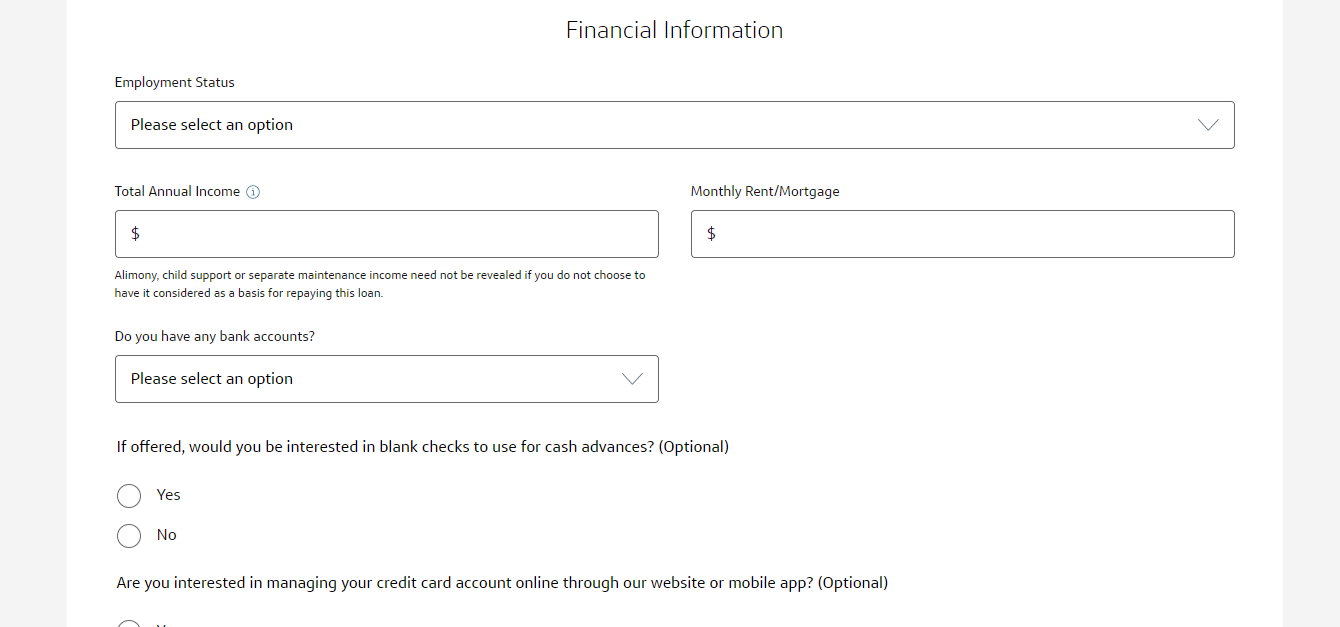

- 3.

Then, you fill in your contact and financial information.

- 4.

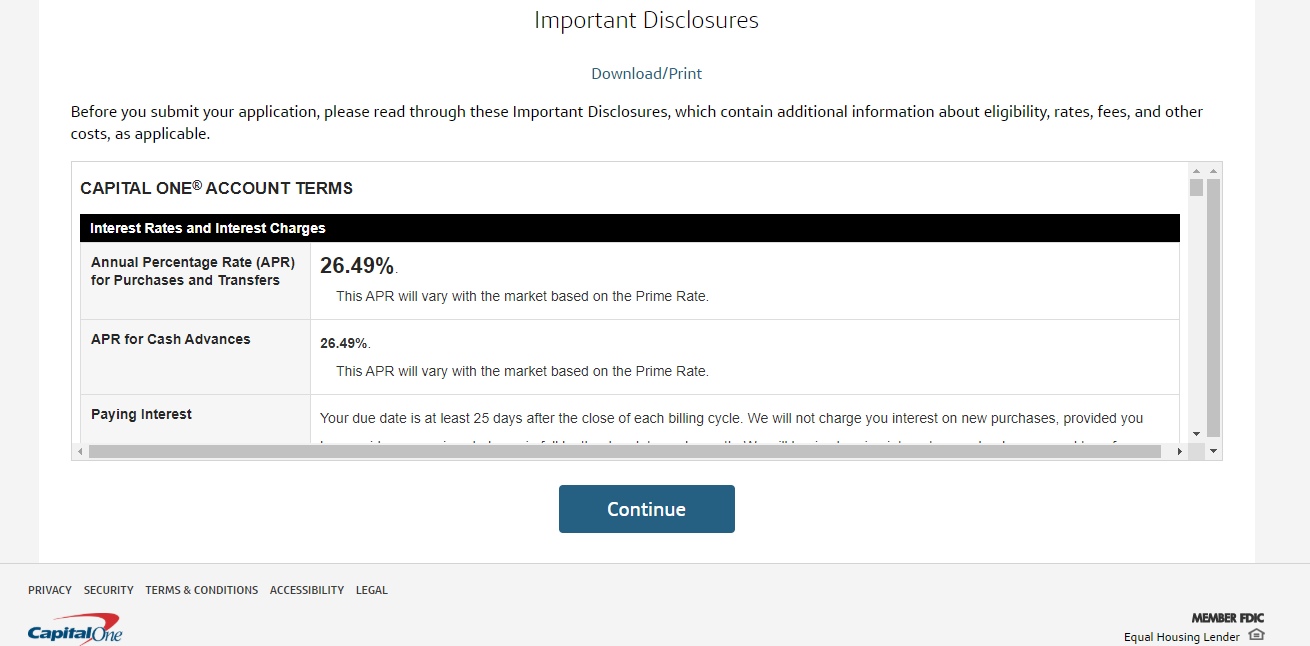

Lastly, read through the agreement properly to know your eligibility, fees, costs, rates, etc.

- 5.

Then click on “continue” to complete the process.

Is the Capital One Platinum Credit Card Right for You?

We’d recommend the Capital One Platinum card if you can’t qualify for other credit cards that offer rewards programs and lower APR rates. It has no annual fee and no foreign transaction fees which make it ideal for using freely anytime, anywhere.

However, the high interest rate can be a major drawback if you have an existing balance or don’t have the financial means to pay your balance in full every month.

Compare The Alternatives

There are several credit cards that could serve as an alternative to someone with average credit.

Like the Capital One Platinum, these credit card options are easier to qualify for making them ideal if you need to build up your credit score.

|

|

| |

|---|---|---|---|

Chime Credit Builder | Capital One Journey | Discover It Student Cash Back | |

Annual Fee | $0 | $0

| $0

|

Rewards |

None

None

|

Up to 1.25%

earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%

|

1-5%

5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases

|

Welcome bonus |

None

None

|

None

$5 per month for 12 months on select streaming subscriptions when you pay on time

|

Match Bonus

Match Bonus for the first 12 months

|

Foreign Transaction Fee | 0%

| None

| $0

|

Purchase APR | N/A

| 29.99% (Variable)

| 18.24% – 27.24% Variable

|