Rewards Plan

Intro offer

Our Rating

0% Intro

Annual Fee

APR

- Welcome Bonus

- Miles Rewards

- Annual Fee

- Too Niche

Rewards Plan

Intro offer

Our Rating

PROS

- Welcome Bonus

- Miles Rewards

CONS

- Annual Fee

- Too Niche

APR

20.99%-29.99% Variable

Annual Fee

$150, $0 intro first year

Balance Transfer Fee

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

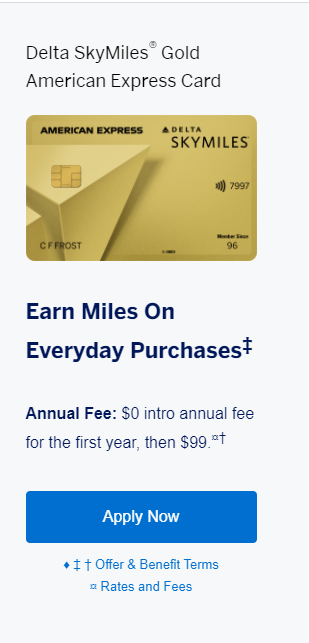

The Delta SkyMiles Gold American Express Card is recommended for less-frequent Delta travelers looking to accumulate miles from everyday expenses like dining and groceries. Despite its annual fee ($150, $0 intro first year), the card offers decent rewards, a welcome offer, and various travel benefits.

The card earns 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases. Additional pros include the manageable annual fee, slightly elevated rewards on common expenses, and valuable travel benefits like a $100 Delta flight credit and free first checked bag. (Terms Apply).

New cardholders are eligible to a welcome bonus of 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months. The miles earned through regular purchases with this card are modest for the most part, but if you make in-flight purchases, you get up to 20% back in form of statement credits.

However, limitations include lackluster redemption options and the absence of luxury perks like airport lounge access. The card is recommended for those who prioritize immediate savings over luxury benefits and prefer Delta-specific perks.

Can I Redeem for Flights with Airline Partners?

Delta has a list of airline partners that allow you to redeem your SkyMiles for travel. There are twenty plus airline partners including Virgin, KLM, and Hawaiian Airlines.

However, you should bear in mind that if you do transfer miles to another program, you could incur a fee and you may not be able to access the best redemption rates.

What is the Initial Credit Limit?

American Express does not specify the initial credit limit you can expect with the Delta SkyMiles Gold, but since it requires good credit, it is safe to assume that you should have a limit of $1,000 or $500 in the case of students.

However, there are reports of new customers receiving a limit as high as $10,000

What Purchases Don't Earn Miles?

The Delta SkyMiles Gold American Express card has a tiered reward structure, which allows almost every purchase to earn some amount of miles.

However, there are some exceptions. You cannot earn miles on interest costs, reloading prepaid cards, buying traveler’s checks or other cash equivalent purchases.

How to Maximize Rewards?

The reward structure for this card is quite simple, with a maximum of two miles per dollar when you pay for restaurant purchases, purchases at U.S grocery stores and Delta flights. So, to maximize your rewards, be sure to book your Delta flights directly, not through a third party platform or website.

You can also earn more rewards if you look at the non food items at your local grocery stores. Many large grocery store chains have decent electronics, auto items and other purchases which can earn you twice the miles compared to shopping at a specialist store.

When Should You Consider It?

The Delta SkyMiles Gold American Express card is a good option if you’re loyal to the Delta brand and are looking for a card with a simple reward structure. There are only two reward tiers with no caps, so you won’t need to change your spending habits.

However, if you are prepared to do a little work with revolving categories, there are cards on the market that offer better Delta miles rewards.

Table of Contents

Pros & Cons

Let’s take a closer look at the pros and cons of the Delta SkyMiles Gold Card:

Pros | Cons |

|---|---|

Earning Rewards | Annual Fee |

In Flight Purchase Savings | No Path to Medallion Elite Status |

Priority Boarding | No Travel Insurance |

American Express Experiences | Limited Transfer Options |

Free Checked Bag | |

No Foreign Transaction Fees |

- Earning Rewards

The card allows users to accumulate miles through various spending categories, including dining, groceries, and Delta purchases, offering flexibility in earning rewards.

- In Flight Purchase Savings

Get 20% back as statement credit when you use your card for purchases of food, beverages, and audio headsets on eligible Delta flights.

- Priority Boarding

Regardless of your Delta status, this card qualifies you for early boarding with Main Cabin 1 Priority Boarding when you use Delta.

- Up to $300 Delta Stays Credit

Get up to $100 back each year on eligible prepaid Delta Stays bookings at delta.com with the Delta SkyMiles® Gold American Express Card.

Also, when you spend $10,000 on purchases in a year, you'll get a $200 Delta Flight Credit to use for your next travel.

- American Express Experiences

This feature provides exclusive access to member only events and ticket presales for concert tours, shows, sporting events, and more.

- Free Checked Bag

Free first checked bag is available to you if you use this card. When traveling, up to eight members in the same reservation as you are eligible for fee waivers.

- No Foreign Transaction Fees

Like many travel rewards cards, the Delta SkyMiles Gold American Express Card does not charge you foreign transaction fees. Make payments anywhere and for anything with this card without worrying about paying extra (See rates & fees).

- Annual Fee

This annual fee is $150, $0 intro first year.

This fee is quite high if you’re not using all the features optimally. With a little compromise, you can find cards with comparable rewards and no annual fee.

- No Travel Insurance

The Delta SkyMiles Gold does not have any type of travel insurance cover.

- No Path to Medallion Elite Status

Frequent Delta customers may find the card less appealing as it doesn't offer bonuses or status boosts to help achieve Medallion Status.

- Limited Transfer Options

Unlike non-branded travel cards, the Delta SkyMiles Gold card doesn't allow the transfer of miles to other loyalty programs, reducing flexibility in redemption.

Simulation: How Much Miles You Can Earn?

If you're a frequent traveler, there is no doubt you can leverage the SkyMiles Gold card to get a bunch of miles rewards, in addition to another benefits it offers. But how much exactly can you earn?

In order to understand that, we need to calculate the miles based on the card terms and spend per each category. However, everyone has its own habits, so it's important to adjust the according to your specific category breakdown.

| |

|---|---|

Spend Per Category | Delta SkyMiles® Gold |

$12,000 – U.S Supermarkets | 24,000 miles |

$4,000 – Restaurants

| 8,000 miles |

$3,000 – Airline | 6,000 miles |

$3,000 – Hotels | 3,000 miles |

$4,000 – Gas | 4,000 miles |

Total Miles/Points | 45,000 miles |

Estimated Redemption Value | 1 mile ~ 1.5 cent |

Estimated Annual Value | $720 |

How to Redeem Your Miles Rewards?

The Delta SkyMiles Gold American Express program has a two-tiered reward structure. You'll get two miles for every dollar spent on Delta flights, groceries at US stores, and restaurant meals, including takeout and delivery. Any other purchases will earn you one mile for every dollar spent.

SkyMiles can be used to purchase Delta flights, upgrade your seat, purchase experiences or merchandise, or even as a gift card. You can also transfer your miles to one of Delta's partners, which includes Radisson Rewards, Marriott Bonvoy, Hilton Honors, and IHG, but there may be a transfer fee.

You must first sign up for the Delta SkyMiles program, which will allow you to redeem accumulated miles on the website, by phone, or at your local Delta ticket counter.

Best Ways to Maximize Miles Rewards

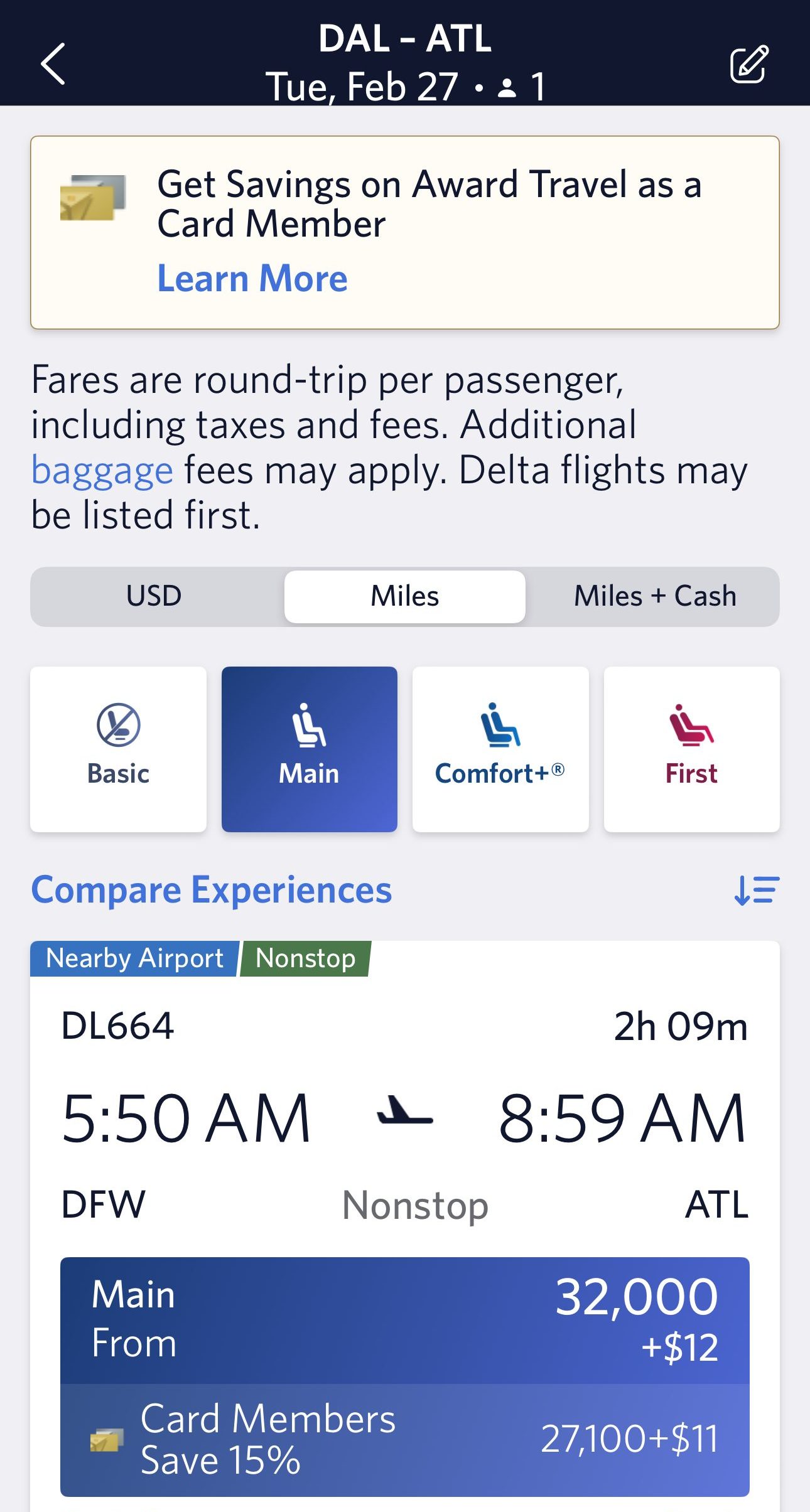

Delta's low-fare calendar allows you to compare flight prices for up to five weeks. This calendar can help you find the best deals, but there are also flash sales that can provide excellent value.

There is the potential to save thousands of miles if your travel dates and itinerary are flexible. It's also worth looking into the cost of round-trip tickets.

While one-way flights appear to be more flexible, they typically cost far more miles. If you compare the same two flights as one-way trips and round trips, you will most likely discover that the round trip costs far fewer miles.

If you avoid Delta hubs, you can also find flights with lower mileage costs. You may pay significantly fewer miles if you are willing to take a slightly longer flight or travel to a nearby airport.

Top Offers From Our Partners

Top Offers From Our Partners

Application Process

Step 1: Visit the American Express website to begin your application. Click on “Personal Cards” then select “Delta SkyMiles Gold American Express Card” from the options. On the new page, click “Apply Now”.

Step 2: Enter your full name as you want it on the card. Provide your birth date, email address, home address, and phone number. Fill in your social security number and information about your annual income. Entering your non-taxable income is optional. American Express advises you to leave this blank if you’re below 21.

Having a credit history in the US is not compulsory. You can still apply if you have good credit histories in Australia, Mexico, Canada, the UK, or India.

Click “Continue to Terms” and proceed to stage 2.

Step 3: Submit Application

Read the Terms & Conditions on the card for the fine print before accepting. Click on “Agree & Submit Application” to continue to the final stage.

Providing additional financial information here is optional but it can help expedite your application. The information you may provide includes your financial assets and employer information. When done with this section, click “Continue” to finish your application. Expect a decision within 14 days.

How It Compared To Other Delta Cards?

The Delta SkyMiles Gold American Express Card distinguishes itself among other Delta cards with its focus on providing rewards and benefits for less-frequent Delta travelers. Compared to other Delta cards, each option caters to different preferences and travel patterns.

The lowest tier card between Delta cards is the Delta SkyMiles Blue, making it a cost-effective option for individuals seeking Delta-related benefits without committing to an annual fee. Similar to the Gold card, the Blue card offers rewards on everyday spending. However, rhere are no perks sucha s free checked bags or priority vorading that avilable through the Skymiles Gold card.

One notable alternative is the Delta SkyMiles Platinum American Express Card, which offers better rewards structures but stands out with additional perks such as reimbursement for Global Entry or TSA PreCheck fee , annual companion certificate, and one Medallion Qualification Dollar toward elite status for every $20 spent, enhancing its appeal for travelers seeking Delta Medallion elite status.

Lastly, the Delta SkyMiles Reserve American Express Card targets a more premium audience and is the most luxurious Delta card. It offers a higher rewards ratio, a status boost towards Medallion status, access to Delta Sky Clubs, and an annual companion certificate, providing enhanced travel experiences for those who value lounge access and travel with a companion.

Compare The Alternatives

There are a number of other airline -focused credit cards that offer higher travel reward rates and sign-up bonuses.

Let's look at them and see if one of them is a better fit for you than the Delta SkyMiles Gold card:

|

|

| |

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

FAQ

The Delta SkyMiles Gold offers car rental insurance. When you decline the rental counter collision waiver coverage, and pay for the rental with your card, you’ll have theft and damage protection in most territories. Please review the terms and conditions before to make sure you're covered.

You don’t need to worry about miles or points expiring . However, if you’re considering closing your account, you will need to think about your miles or points before you finalize the account closure.

Delta SkyMiles have an average redemption of approximately two cents per mile. This can vary according to your redemption method, but typically 10,000 miles would have an approximate value of $200.

The Delta SkyMiles Gold require good to excellent credit and a higher annual fee.

So, if you’re looking for a travel benefits package with no annual fee at all or you don't have an good credit, you may need to look elsewhere.

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Compare Delta SkyMiles Gold Card

The Delta SkyMiles Gold offers higher annual cashback and better perks than the Delta Blue card. But is it worth the annual fee? It depends.

Delta SkyMiles Blue vs Delta SkyMiles Gold: How They Compare?

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits? Here's our comparison.

Delta SkyMiles Gold vs Southwest Rapid Rewards Priority: Which Gives You More?

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

Both Hawaiian and Delta SkyMiles Gold have similar annual cashback values and diverse airline benefits, so there is no clear winner.

Hawaiian World Elite Mastercard vs. Delta SkyMiles Gold: Side By Side Comparison

Review Airline Credit Cards

Delta SkyMiles Blue American Express

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/