Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Unlimited Cash Back

- No Foreign Transaction Fee

- No Sign Up Bonus

- Balance Transfer Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Unlimited Cash Back

- No Foreign Transaction Fee

CONS

- No Sign Up Bonus

- Balance Transfer Fee

APR

17.74% - 29.74% Variable

Annual Fee

$0

0% Intro

None

Credit Requirements

Good – Excellent Credit

- Our Verdict

- FAQ

The SoFi credit card is a simple card offering 3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi, but it is designed a little differently compared to other cards with similar rewards. The card has no foreign transaction fee and no annual fee.

You can accumulate your cash back and redeem the rewards towards saving, investing or paying down a SoFi loan. While you don’t need to be a Sofi customer, this makes the card an attractive option for those with existing SoFi accounts to get the highest value rewards.

The SoFi credit card is a Mastercard and so it comes with some additional benefits such as discounts from participating merchants and up to $1,000 in cell phone protection.

However, its value is most apparent for existing SoFi customers, as points can only be fully redeemed within the SoFi ecosystem. The lackluster welcome offer and absence of introductory APR rates may make other cash back cards more appealing for those without a strong affiliation with SoFi.

My Application Was Denied. Why? What Can I Do?

As with most credit card companies, Sofi is unlikely to give you a specific reason if your application is declined. Sofi will make a credit decision based on your credit report and the details on your application.

So, if you are declined, it could relate to your income, credit score or other factors. Fortunately, you can continue to use your Sofi checking and savings account to boost your credit report and get your finances under control. You can then consider reapplying in six months or more.

How Does The Sofi Card Integrate With Sofi Money?

One of the great things about Sofi is that all the products do integrate. In fact, you can use the cash back you earn on your credit card to save in your Sofi savings account, invest with Sofi Invest or pay down your Sofi loan.

When Should You Consider It?

The Sofi credit card and associated Sofi banking products are a great option if you want to simplify your finances.

While the card does not offer the best possible rewards, it is weighted towards helping you to save, invest or pay down debt. This can help you on your journey to financial independence.

In This Review..

Pros & Cons

Let’s take a closer look at the pros and cons of the SoFi Credit Card:

Pros | Cons |

|---|---|

Flat Rate Cash Back | Average Cashback Rate |

No Annual Fee | Balance Transfer Fee |

Mastercard World Elite Perks | Dependency on SoFi Accounts |

Integration with SoFi Ecosystem | No Introductory APR Offers |

No Foreign Transaction Fee | No Welcome Bonus |

- Flat Rate Cash Back

This card offers 3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi.

The card's flat-rate cash back eliminates the complexity of dealing with bonus spending categories or earning limits, making it straightforward for users to accumulate rewards.

- No Annual Fee

The SoFi Credit Card comes with no annual fee, making it a cost-effective choice for users who want to earn rewards without incurring additional expenses.

- Mastercard World Elite Perks

Cardholders enjoy additional perks, such as cellphone protection and savings with Lyft, DoorDash, and more, thanks to its affiliation with the Mastercard World Elite program.

- Integration with SoFi Ecosystem

For users with SoFi banking, investment, or loan accounts, the card seamlessly integrates with the SoFi ecosystem, allowing for easy redemption of rewards into various accounts.

- No Foreign Transaction Fee

If you enjoy traveling, you can use your SoFi Mastercard without worrying about getting hit with exorbitant foreign transaction fees.

- Average Cashback Rate

There are no higher earning categories or one time bonuses with this card. The card is only really favorable for those with SoFi loans, savings or investment accounts.

So, unless you already use these products or are planning to in the future, you may find the rewards structure frustrating.

- Balance Transfer Fee

If you want to transfer a balance to your SoFi credit card, you can expect to pay a fee of $10 or 5% (whichever is higher). Additionally, there are times when SoFi does not permit balance transfers.

- Dependency on SoFi Accounts

To maximize the benefits, users must have a SoFi Checking and Savings, loan, or investment account, limiting the card's appeal for those without an existing relationship with SoFi.

- No Introductory APR Offers

The absence of introductory APR offers may make the card less attractive for users looking to transfer balances or avoid interest charges in the initial months.

- No Welcome Bonus

the card doesn't offer a welcome bonus, a drawback compared to competing cards offering more attractive welcome bonuses.

Top Offers From Our Partners

Top Offers From Our Partners

Navigating SoFi Credit Card Through the User's Eyes

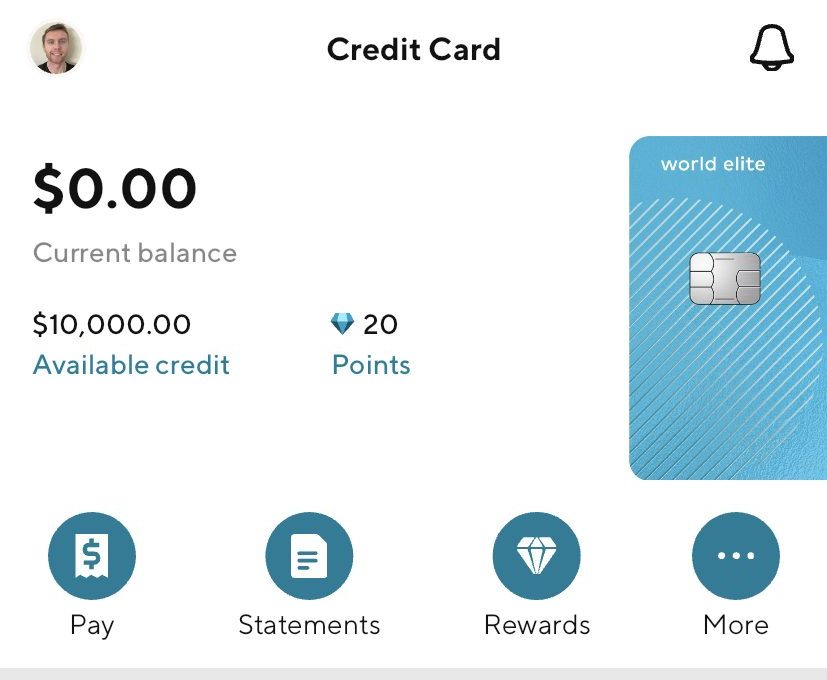

As we began exploring the SoFi Credit Card through the SoFi App, we encountered a range of features designed to improve our financial experience.

The SoFi Credit Card Overview feature welcomed us with a bird's eye view of our credit card activity. It displayed key information such as the current balance, available credit, and due dates:

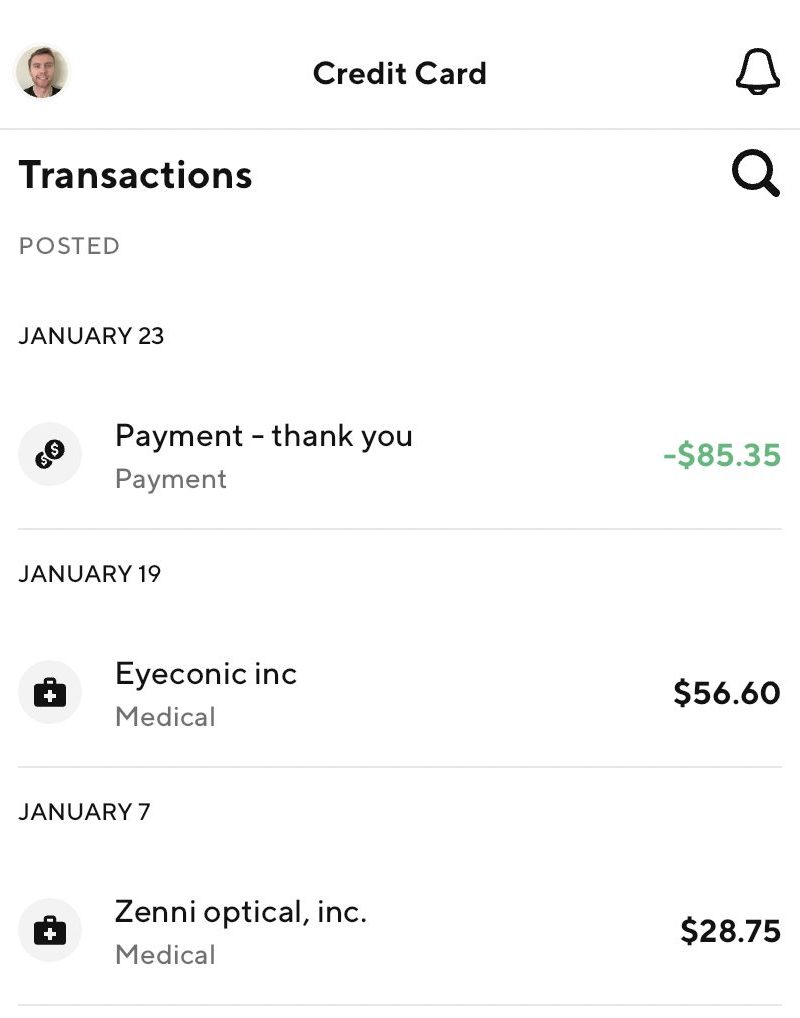

Navigating to the Transactions section, we were met with a detailed log of our credit card activity. Each transaction was neatly categorized, providing insights into where and how we spent our money.

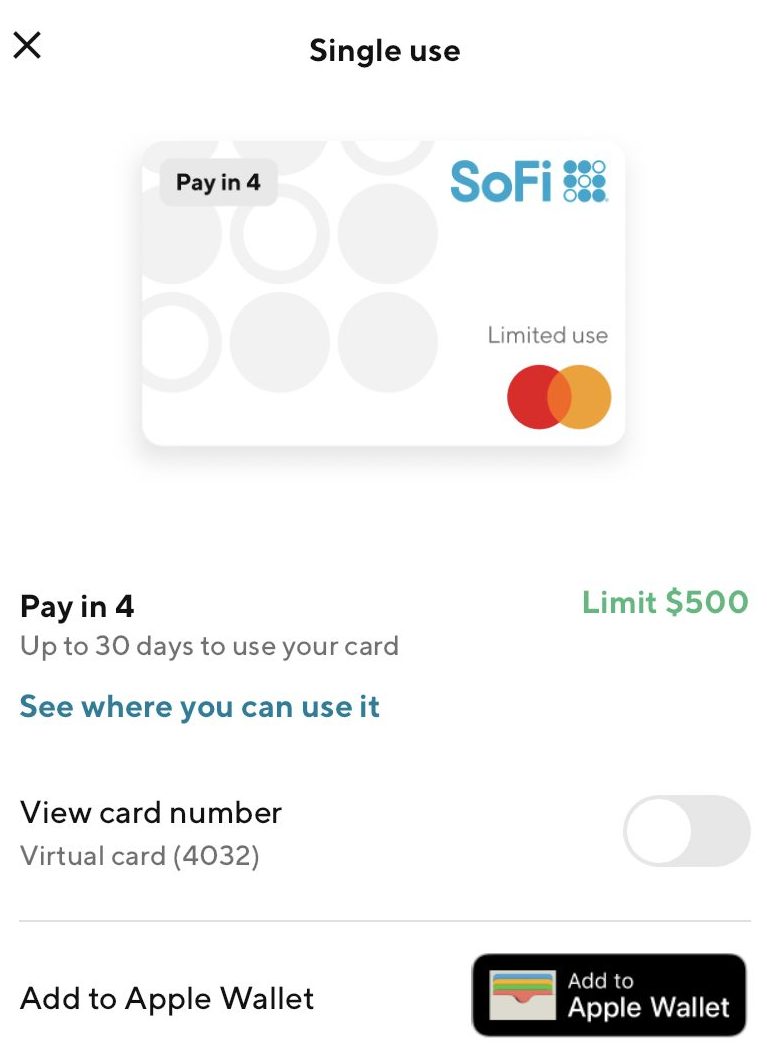

This virtual card, accessible within the app, allowed users to make online purchases without exposing our actual card details.

From transaction tracking to point accumulation and the added security of a virtual card, SoFi's thoughtful design and functionality made managing our credit a straightforward and rewarding aspect of our financial journey.

How To Apply For SoFi Credit Card?

- 1.

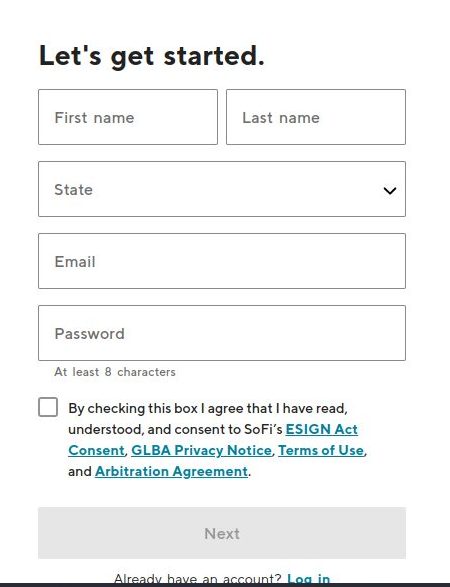

You can start the application form for the SoFi Credit Card on the company website.

- 2.

After you click “Apply Now”, you’ll be redirected to a basic information form. You’ll need to provide your name, state, email and set a password. At this point, if you already have a SoFi account, you can simply opt to log in.

- 3.

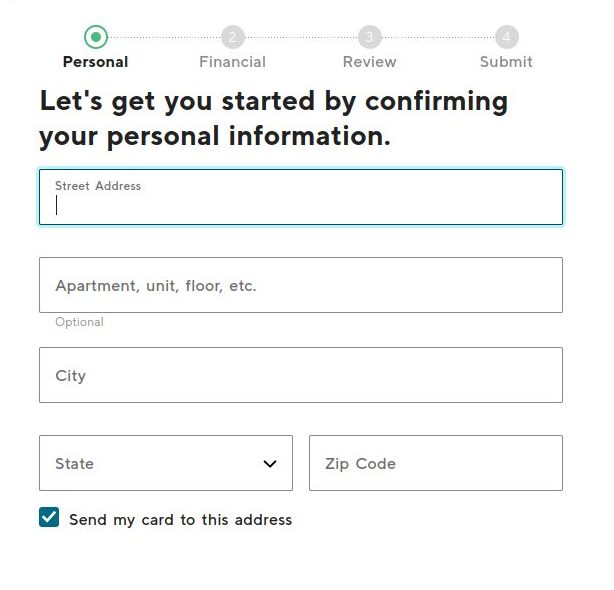

You will then need to provide some more detailed information, starting with your address.

At this point, SoFi requires a cell phone number, so the team can send you a verification code. Once you enter the code, you will be able to continue with your application.

- 4.

You’ll need to provide financial details, such as your income, current finance obligations and expenses, so the SoFi team can assess whether you qualify for the card.

You will have the opportunity to review all your details, before you submit your application. SoFi will also perform a hard credit check before making a decision.

How It Compared To Cash Back Cards With No Annual Fee?

The SoFi Credit Card, with its unique features and integration within the SoFi ecosystem. When compared to other no-annual-fee cash back cards, it presents both advantages and limitations.

Cards like the Wells Fargo Active Cash® Card and Citi Double Cash® Card offer a 2% flat rate cash back rate and also feature no annual fees. However, these alternatives include an introductory APR period and a welcome bonus. If you want a flat rate cashback, the Upgrade Cash Rewards, Capital One Quicksilver, and Amex Cash Magnet offers 1.5% cashback and a welcome bonus.

However, there are cards that offer higher cashback on bonus categories with no annual fee and even 0% intro APR. For example, the Blue Cash Everyday From American Express, the Capital One SavorOne, and the Chase Freedom Unlimited rewards include higher cashback for travel, dining, and even groceries, depending on the card, usually between 1X-3X points per dollar.

There are also options to get even higher cashback rates with no annual fee cards with rotating categories such as the Citi Custom Cash, Discover It Cashback or Chase Freedom Flex, all of them offer 1%-5% cashback, including a welcome bonus and 0% intro APR.

Is the SoFi Credit Card Right for You?

If you already have SoFi savings, investment or loan accounts, the SoFi credit card could be a good option for you. You can accumulate 3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi that can be redeemed into your account.

While this may not seem a massive amount, you could be able to chip away at your existing debt or increase your investment fund, simply with your day to day spending.

Compare The Alternatives

If you have good – excellent credit and you're looking for a cash back rewards credit card – the SoFi card is definitely a good option, but there are some good alternatives:

|

|

| |

|---|---|---|---|

American Express EveryDay® Card | Chase Freedom Flex℠ Card | Citi® Double Cash Card | |

Annual Fee | $0

. See Fees & Rates

| $0

| $0

|

Rewards |

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

|

1% – 5%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

|

Welcome bonus |

10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

|

$200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

|

$200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

|

Foreign Transaction Fee | 2.7%

| 3%

| 3%

|

Purchase APR | 18.24% – 28.24% Variable

| 20.49%–29.24% variable

| 19.24% – 29.24% (Variable)

|

FAQ

Sofi allows you to earn unlimited cash back on your purchases with very few restrictions. These exceptions are similar to other credit card brands. This means interest fees, gift cards and other cash related purchases are not likely to earn you any cash back.

You can apply online for a Sofi card and the company states that you’ll need to wait up to 30 days to process your application. This means that you may need to wait several business days to get an official approval, but this is not as quick as some other credit card providers.

Sofi does not publish the typical initial credit limits, but previous and current customers have reported starting limits of $1,000 up to as high as $25,000. Your specific credit limit will be assessed as part of the application approval process according to your income, employment status and other factors.

Sofi states on its website that applying for this card will not affect your credit score. When you apply, Sofi will only initiate a soft credit pull that does not affect your score. There will only be a hard credit pull if your application is approved and you decide to proceed.

However, Sofi does state that after evaluating your completed application and your credit report, the company may decline to offer credit.

Review Cash Back Credit Cards

Chase Freedom Flex

Top Offers From Our Partners

Top Offers From Our Partners

Disclaimers:

See offer details: www.sofi.com/card/rewards

See terms and conditions: www.sofi.com/card/terms

*Cell Phone Insurance Protection, Mastercard ID Theft Protection™ , Lyft and Other Partner Rewards have additional terms and conditions, which can all be accessed through the World Elite Mastercard® Benefits portal. Please see the guide to benefits for details or call 1-800-MASTERCARD.